How to Do Payroll in QuickBooks Online

If you own a business and have employees, then you are required to process the payroll and you must comply with Federal and State norms. Quickbooks Online Payroll is a very handy tool if you’re new to the accounting program or haven’t done it before. You could waste time with confusion and frustration when it comes time to pull together these numbers if you don’t know where to begin!

Here’s a brief guide on how to do payroll in QuickBooks Online so that all your hard work goes into account properly.

What is Payroll in QuickBooks Online

Payroll is the process of paying and reporting employee wages and employee taxes in a business. When it’s time to turn in these numbers to the payroll department, they’re taken care of by your accountant or payroll service. In case of Quickbooks online payroll you’ll take employee information (name, address, phone number, email address) and enter that into your QuickBooks Online account. After that you process the payroll every month and make reporting.

How to Do Payroll in QuickBooks Online: 5 Steps

Step 1: Create Payroll Item List

To do your payroll in QuickBooks Online, you need to know how you want to set it up. First of all you should create a checklist of following:

i) Will you have employees in one state or multiple state ii) Have you taken registration for each state in which you have employees? iii) Will your employees be required to put in a lot of overtime, or will they have the same weekly hours? iv) When do you want to pay your employees v) Decide Sick leave, Paid Time off, HRA or any other reimbursement Policy?

Decide on the setup for this part of your program and enter it into QuickBooks Online. If there are any special payroll requirements for your business, enter that information now!

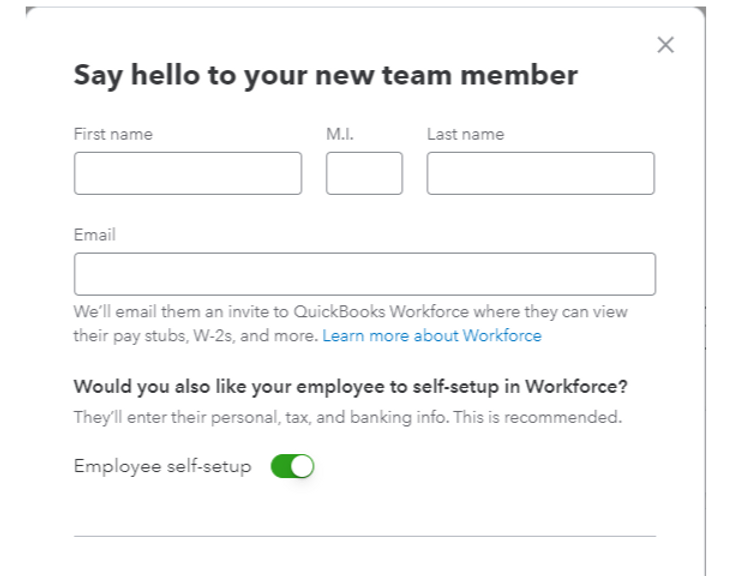

Step 2: Create Payroll Setup – Employees

Next, it’s time to create a payroll for all employees from which you’ll take the information. Enter their name, address, phone number, and other essential information that’s required. If you have any special payroll requirements, enter them into the system, so you know where to look when you need them.

You can also activate the employee self-setup. In this case employees will get the direct email from Intuit where they can enter their details.

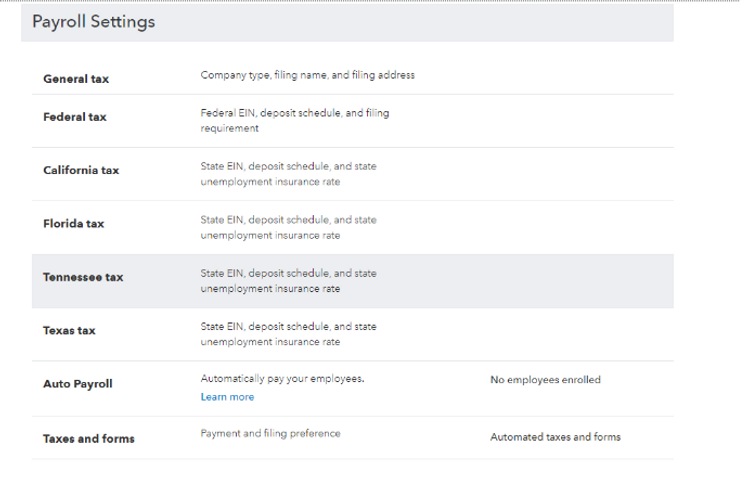

Step 3: Create Payroll Setup – Taxes

This is how taxes for each employee will be accessed. Some employers will have to pay taxes for employees (like Medicare or Unemployment), which is how that money is accessed in QuickBooks Online. You’ll have to enter the tax rates for each state based on their requirement and details you received at the time of registration. Again if you have multiple states this setup needs to be done for each state. In order to do this you should go to Settings>Payroll Settings>Make Edits in Respective state.

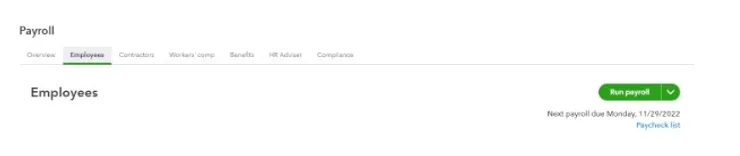

Step 4: Run Payroll Functions

After you’ve set everyone up in the program, it’s time to do payroll in QuickBooks Online! This step is how everything is integrated so that it works properly. Employee paychecks will be generated once this is done, and all taxes and deductions will be taken care of in this step.

In order to do that you should go to Payroll> Employees> Hit Run Payroll

Step 5: Paying Taxes and Automation of full process

If you have a fixed payroll Quickbooks online has made it really easy and you can automate the full payroll process in just few steps. You can also automate the tax payment and tax filling part and keep the control over when to run the payroll.

If you want to automate the payroll: Go to Setting > Payroll Settings> Auto Payroll

Conclusion

At the end of the year you can generate W2 from the Quick Books online it self and hand it over to your employees. This way you can stay on track and 100% compliant with the requirements.